Accepting Saudi Arabia's Tax Digitization with Odoo: The Future o…

페이지 정보

Writer Jeannine Date Created25-07-12 03:45관련링크

본문

| Country | Iceland | Company | Perreault Ltd |

| Name | Jeannine | Phone | Jeannine & Jeannine Consulting |

| Cellphone | 4261705 | jeannineperreault@uol.com.br | |

| Address | Gar?Avegur 67 | ||

| Subject | Accepting Saudi Arabia's Tax Digitization with Odoo: The Future o… | ||

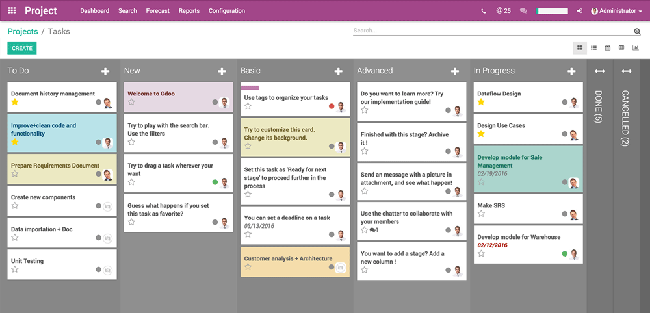

| Content |  Saudi Arabia's push towards a digital economic situation is not simply visionary-- it's enforceable. With the Zakat, Tax Obligation and Customs Authority (ZATCA) rolling out FATOORAH (the nationwide e-zatca-ready invoicing system required), businesses throughout the Kingdom are now required to embrace a brand-new period of tax openness and performance. Saudi Arabia's push towards a digital economic situation is not simply visionary-- it's enforceable. With the Zakat, Tax Obligation and Customs Authority (ZATCA) rolling out FATOORAH (the nationwide e-zatca-ready invoicing system required), businesses throughout the Kingdom are now required to embrace a brand-new period of tax openness and performance.For companies currently running or considering Odoo ERP, this provides a special opportunity to not only adhere to laws, yet to boost the method they work. The New Tax Fact in Saudi ArabiaTax in Saudi Arabia has actually grown swiftly:15% barrel is currently basic on many items and services. Zakat is required for Saudi/GCC investors. Business Tax obligation applies to foreign possession. FATOORAH mandates digital invoices sent in real time. ZATCA's duty is central-- tracking, imposing, and enabling the digital compliance infrastructure. Why Odoo is Your Strategic Tax Obligation CompanionOdoo isn't simply an ERP-- it's an ecological community that adapts to your business design. With Saudi-specific localization, it simplifies: E-invoice production & formatting (XML, QR code, UUID). API interaction with ZATCA for billing clearance. Zakat and barrel automation. Safe and secure archiving & reporting. You get not simply conformity, yet assurance. The Real-World Perks. Applying ZATCA and FATOORAH conformity via Odoo does not quit at validity-- it develops substantial service advantages:. Faster billing turnaround with real-time validation. Less manual mistakes and reduced audit danger. Improved monetary exposure across divisions. Enhanced credibility with banks, investors, and regulators. Common Usage Instances We See. A logistics firm connecting their invoice system to ZATCA by means of Odoo. A retail chain automating Zakat reports and VAT returns. A B2B services strong cutting compliance expenses by abandoning legacy software. If your business remains in KSA and dealing with finance by hand or on non-compliant systems, you're already falling back. Last Ideas. Saudi Arabia's service landscape is transforming quick-- and those who adapt will grow. FATOORAH, ZATCA, and digital tax obligation enforcement are right here to stay. But with a device like Odoo and the right execution approach, you can turn conformity right into capability. |

||

CS Center

CS Center